PolicyFind is the leading insurance archeology firm in the United States, and has an unparalleled success rate at finding evidence of historical CGL policies. In over 23 years, PolicyFind has uncovered more than $5 billion in usable insurance assets for attorneys, business owners, municipalities, real estate developers, and regulatory agencies.

Here are some answers to the most frequently asked questions we’ve heard regarding the Confidential Insurance Archeology® process.

Q. What is Insurance Archeology, and why is it beneficial for dry cleaners and other property and small business owners?

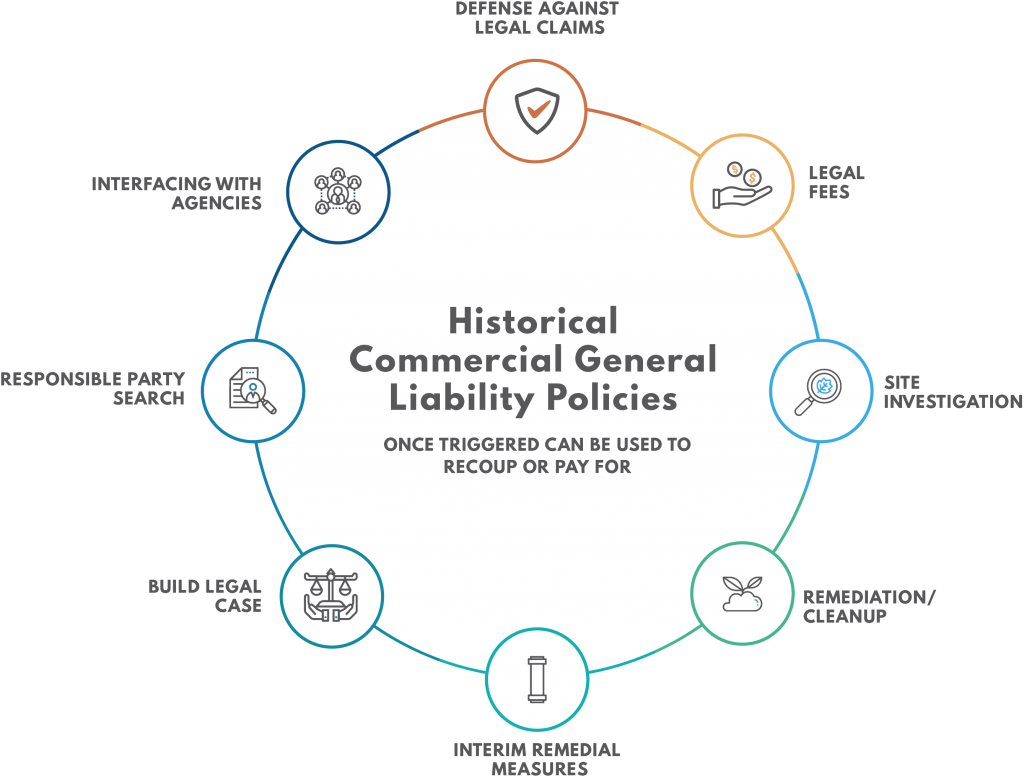

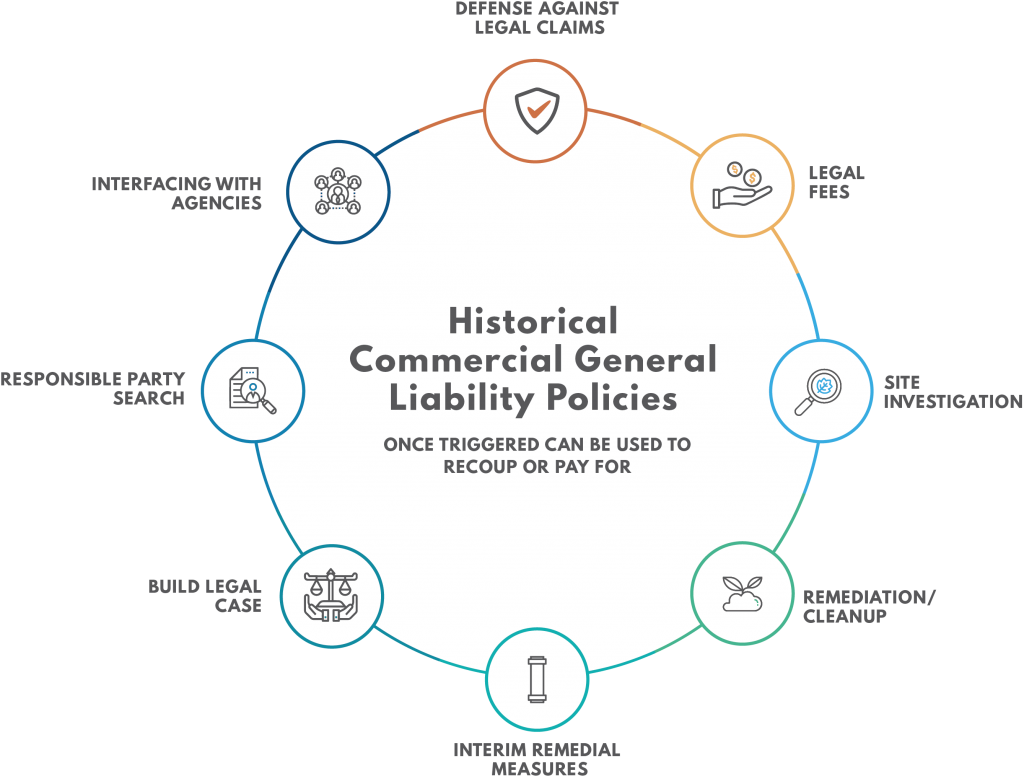

A. Insurance archeology is a term used to describe the process of locating and finding historical insurance policies that covered individuals and businesses. Historical insurance can be a huge benefit to dry cleaners as old policies can be used to pay for costs associated with soil and groundwater contamination investigations, legal representation and even the cleanup of contaminated sites.

Q. When should dry cleaners and other property and small business owners consider investigating their historical insurance coverage?

A. Right away. Finding historical insurance policies can be like finding hidden treasures or lost money. Business and property owners, even former business owners and operators, should make it a high priority to search, locate and securely store all of their old insurance policies and any evidence that may support that they had historical insurance.

Many dry cleaners wait until it is time to sell a business to figure out what they are going to do about contamination. At that point, there may be questions about the value of the property because of contamination. In order to have the value of the business at its peak, a dry cleaner should look for insurance coverage now as a way to reduce personal liability and maintain the value of their business.

Q. How can dry cleaners and other property and small business owners begin reconstructing the historical insurance coverage of their businesses?

A. The first step to reconstructing your insurance coverage is by reviewing your old business files and personal files. It isn’t uncommon when we talk with dry cleaners to learn that they have thrown away their old records. Many people only keep records for seven years, as this is the customary time that the IRS tells us we need to keep records for audit purposes. In these cases, we need to dig deeper. We need to focus on looking for companies and individuals that may have required proof that you had coverage, for example landlords, legal counsel and mortgage companies. Another approach is to call the expert insurance archeologists at PolicyFind.

Q. Who is responsible for covering the cost of investigations and cleanups?

A. In many cases, PolicyFind can assist dry cleaners, as policyholders, with obtaining a defense from their old insurance policies. The site investigations of a dry cleaning business can be considered defense against claims because the investigations quantify liability and exposure for the insured. PolicyFind can also build a case for the dry cleaner to obtain a site cleanup by using the insurance company’s defense obligation.

Q. What kind of coverage do owners want to find in old policies?

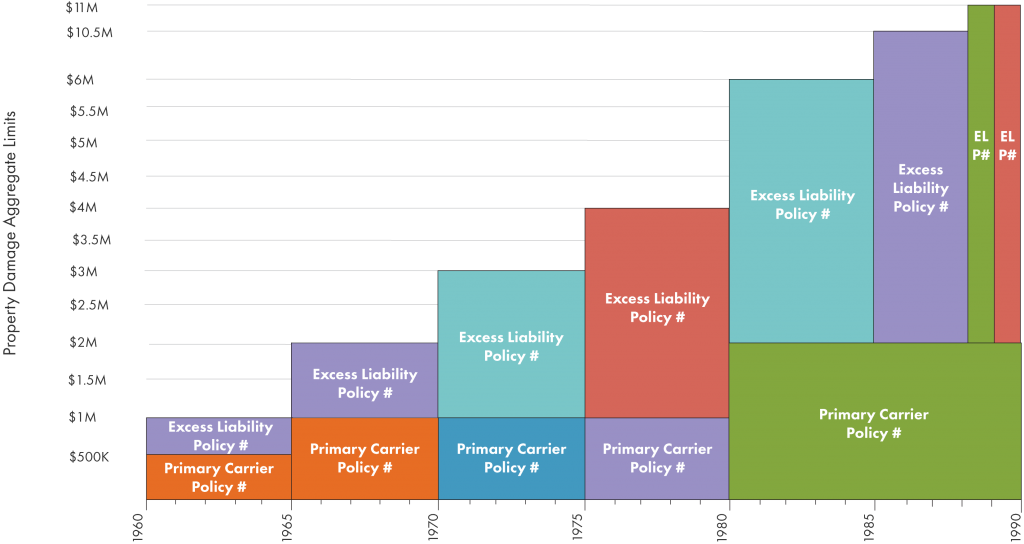

A. Business or property owners should look for all insurance policies they can remember purchasing. The best policies would generally be the Commercial General Liability (CGL) policies written before 1985. Other valuable policies would include umbrella policies and excess liability coverage. Oftentimes, finding workers’ compensation policies, auto policies or other specialty policies can lead you to finding other coverage, because past brokers often provided dry cleaners with bundled policy packages.

Q. How can owners and operators tender claims to insurance companies so that old policies kick in?

A. Oftentimes finding just one year of coverage can be the catalyst to finding more coverage. This is because one year of coverage may be enough to obtain a defense and this defense could include finding other responsible parties, including past owners and operators of the dry cleaning business, and their insurers, as well as other carriers that covered you.

Q. What are typical costs of remediation and legal expenses associated with contamination?

A. The cost estimates with investigating contamination associated with dry cleaners can range between $30,000 and over $500,000–depending on the extent of the site contamination, the site geology and whether groundwater beneath the dry cleaning businesses can be used for drinking. Legal expenses can oftentimes go into the six figures, while site remediation can cost between $50,000 and over $1,000,000.

Larger, industrial remediations can range into the tens of millions will the lower end of costs being closer to $1,000,000. Investigations and time-critical interim actions or temporary mitigations alone can easily top $1,000,000, and legal expenses could also easily top $1,000,000.

Q. How does Insurance Archeology help dry cleaners and other property and small business owners obtain site closure?

A. In short, insurance archeology is the term given to finding old insurance policies. These old policies, used appropriately, can pay for the costs of site investigation, including soil and groundwater contamination studies, finding other potentially responsible parties (PRPs) that caused contamination (past owners and operators), assessing the cleanup costs and developing the facts of the case. In many cases the insurance will pay for the site cleanup or other suitable settlements. Additionally, though the insurance companies actually pay for the defense related costs, it is the policyholder that gets credit for spending the money for cleanup. For most clients, reaching the end of contamination begins with finding the policies.

To find out if you have historical assets, contact us for a Confidential Insurance Archeology® consultation.

Kristen Drake brings more than a decade of research and managerial experience in broadcast journalism to the field of insurance archeology. Since joining the PolicyFind team in 2015, Mrs. Drake has successfully documented liability insurance programs on behalf of municipalities, manufacturers and dry cleaners. She continues to translate her expertise in source procurement and digital fact-finding, performing insurance research activities at a very high level, providing on-time execution of contracted performance goals.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]